Enabling IT Outsourcing :

A Pivotal Role for Nepal’s Development Partners

In the world of “development”, Donor Agencies, Foundations, and Development Finance Institutions (DFIs) are constantly in search of opportunities to maximize the value of every tax payer funded Dollar that they allocate (“invest”). This value is typically measured by numerous social, economic, and environmental indicators, but all of which boil down to either outsized impact and/or financial returns that each project generates. Investments could be at the level of a firm or alongside a governmental agency but are always in areas where donor agencies’ mandates overlap with host country or market-level priorities and needs.

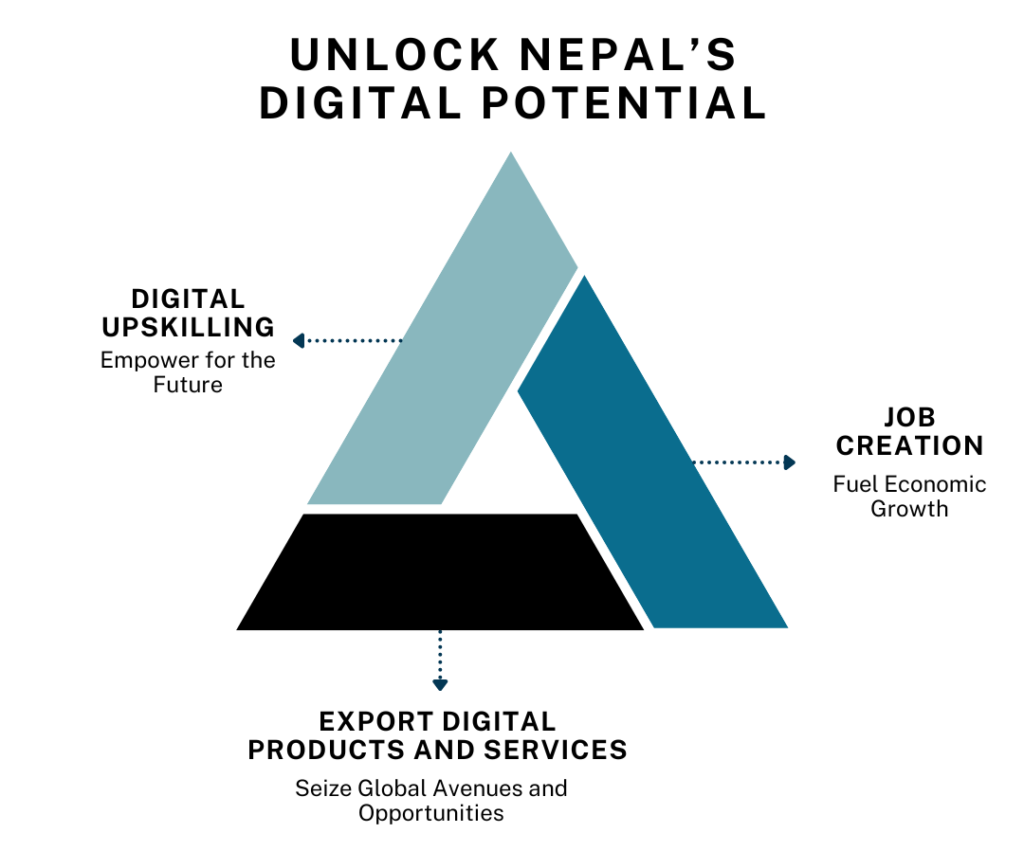

In Nepal’s case, there is no greater urgency or more sensible allocation of developed world tax dollars than investments in digital up-skilling, job creation, and export of digital services. Re-purposing current and future donor and DFI investments in this direction are more likely to alleviate the burning issues of accelerated brain-drain, remittance-dependence, and chronic balance of payments deficits, than any other sectoral allocation over the short-to-medium term.

Yet, publicly available data since 2017 indicates that of the US$13.8 billion in donor commitments to Nepal, of which approximately 46% was actually disbursed, only 27 projects amounting to 4% of the total project count or 2.9% of total commitments relate to digitization, up-skilling, or direct job-creation. A silver lining in this data is that of the amount disbursed on the 27 projects, approximately 40% touches upon areas that could help Nepal re-orient its labor force – particularly its youth – toward digitalization and digital service delivery. This is an encouraging data point but a lot more can and should be done, with emphasis on job creation, within Nepal, for IT services professionals.

Similarly, data for FY 2019/20 from the Central Bureau of Statistics cites the ICT sector’s contribution to Nepal’s GDP as 2.22%. As an aspirational comparator, the IT sector accounted for 8% of the US$2.7 trillion GDP of India in 2020. Further, according to a study conducted by Gartner, investment in India’s IT industry was predicted to reach US$81.89 billion in 2021 and further increase to the US$101.8 billion in 2022 – approximately 2.7x and 3x of Nepal’s entire GDP for the corresponding periods. In orders of magnitude, these numbers indicate significant headroom for the Nepali economy to grow its ICT contribution to GDP relative to other sectors, both in proportionate and absolute terms.

The bottom line is this: despite significant hype created by the Nepali Government’s adoption of the Digital Nepal Framework from back in 2019 and agencies like the World Bank’s flagship $140 million Digital Nepal Acceleration project, which latches on to the Digital Nepal Framework, not much of substance has been achieved. In fact, the Digital Nepal Acceleration project shows a total disbursement of zero dollars as of February 29, 2024, almost 24 month after it was approved. There are likely a plethora of excuses that explain away why digitalization is still not top of mind for the Government of Nepal or why tangible results from past donor investments remain to be realized but none of this negates the urgency in tripling down on investments in this sector.

The donor and DFI community possesses outsized influence and resources relative to other actors in the Nepali economy. Leveraging their innate goodwill, capacity to deploy blended finance instruments, and convening power to help streamline the enabling environment would optimize their “value for money” in the truest sense possible. Further, bi-lateral agencies like the UK Government’s FCDO and the US Government’s USAID have verifiable track records of early investments in Nepal’s digitalization journey, alongside private sector entities. These agencies are uniquely well-positioned – and others to take their lead – to build on the early successes and invest even more in helping grow Nepal’s capacity to service outsourced IT projects.

Future programs by Nepal’s donor and DFI partners along with explicit targets on job creation in the digital services sector in Nepal, enhanced linkages between Nepal-based IT services firms and international demand centers, and well-conceived, medium-term approaches to up-skilling Nepali tech talent (and continually growing this talent-base), would be the most impactful intervention these partners could enable. The clock is ticking but there is still time for a radical and required re-alignment of donor spending and strategies that emphasize job creation in Nepal for a tech-enabled Nepali work force.